The Inner Circle Trader (ICT) methodology offers a distinctive perspective on the markets, attracting numerous traders with its unconventional approach to price action in foreign exchange, crypto, and other markets. One of the key components of this philosophy is the concept of buy and sell side liquidity.

This article will delve into these concepts and explore how they can be applied in trading.

Key Takeaways

- Buy side and sell side liquidity areas represent zones where the price is likely to break out due to an imbalance in supply and demand.

- These two concepts are part of the ICT strategy, which aims to model the behaviour of institutional investors for consistent profits.

- The ICT method is based on analysing market structure, tracking institutional footprints, and timing trades during high-volume periods.

Liquidity as a Key Factor

Liquidity is an important concept in trading, and it becomes even more crucial when applying the principles of ICT to your trading strategies. In simple terms, liquidity refers to the ease with which a particular asset can be bought or sold without affecting its market price.

ICT traders focus on finding key levels where market participants are likely to place their stop orders in the futures market. These zones are known as “liquidity areas”.

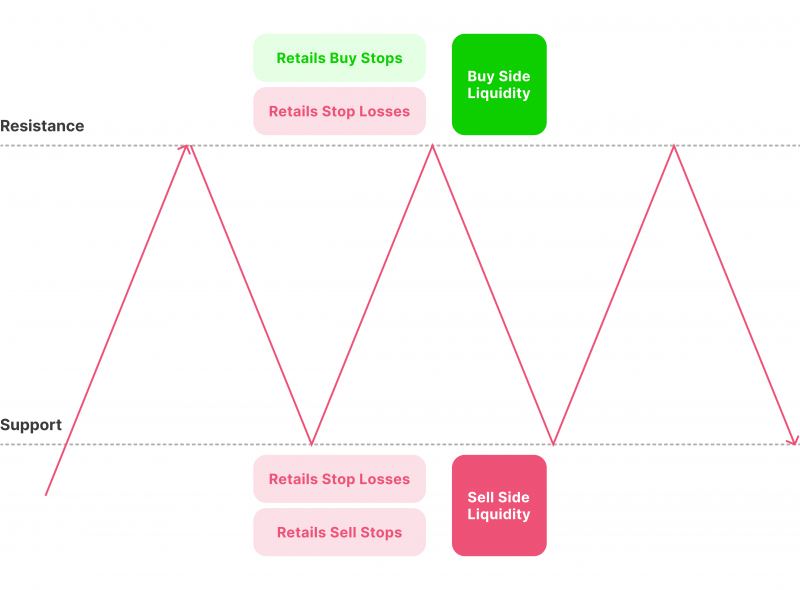

There are two kinds of liquidity areas that you need to understand:

- Buy side liquidity refers to the level at which traders who have sold an asset place their stop-losses. These levels are typically found above key resistance levels.

- On the other hand, sell side liquidity refers to the level at which traders who have bought an asset place their stop-losses. These levels are typically found below major support levels.

The Strategy Behind Buy Side and Sell Side Liquidity

So, how can these liquidity areas help traders to profit? The strategy behind it is simple.

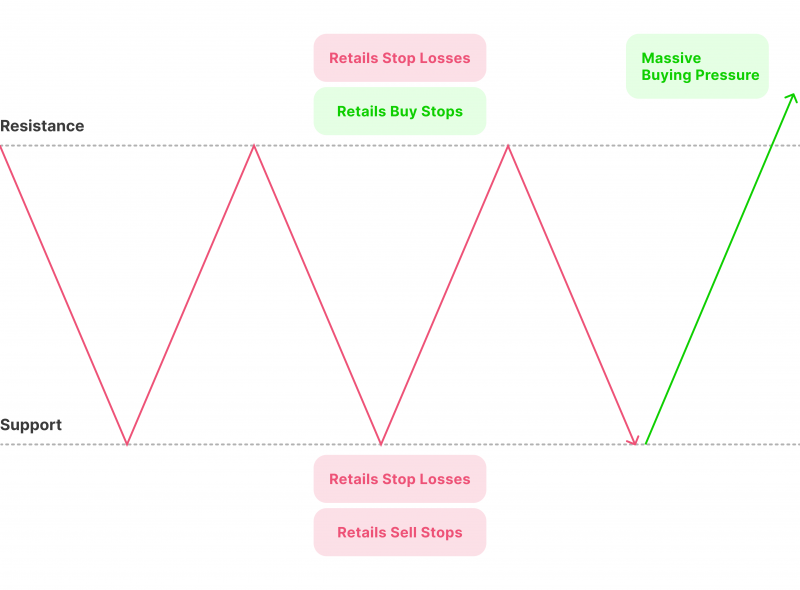

When the market reaches a major resistance level, many traders open short positions in anticipation of a price reversal. In doing so, they also place their stops higher than the resistance level to limit potential losses. However, if the price breaks through the resistance, all the stops that have been placed above it will be triggered.

This leads to a domino effect of more orders being executed, creating a lot of buying pressure. The influx of new buy orders above the level can push the price even higher very quickly, leading to potential profits for traders who have identified and traded this setup.

Similarly, when the market approaches a major support level and triggers all the stop-loss orders that have been placed below it, the price may experience a sharp decline due to the selling pressure created by closing old stops and opening new sell orders. This selling pressure can continue to push the price lower.

Why Does It Happen?

This phenomenon occurs because of liquidity rebalances. When prices reach these buy side and sell side liquidity levels, a large number of orders are executed, leading to an imbalance in the market’s supply and demand. This results in a sudden surge or decline in price, depending on the direction of the breakout.

How to Use Liquidity Levels in Trading

When trading reversals, traders should look for price actions that confirm a potential reversal around buy side or sell side liquidity levels. These confirmations can come as engulfing candles, pin bars, or other key market patterns.

Traders can also use other technical indicators, such as trend lines and moving averages, to confirm potential reversal points further.

Traders should also keep an eye on volume in these areas. A sharp increase in volume around key levels can indicate a potential breakout, which can lead to the price moving further into the liquidity zone.

Forex liquidity is primarily driven by major financial entities, such as central banks and investing companies, accounting for over 90% of the daily trading volume in the market.

Fast Fact

ICT — What Is It About?

ICT is a technique that analyses the inner workings of the financial markets, specifically in Forex and crypto trading. This approach was created by Michael J. Huddleston, an industry veteran with over 25 years of experience.

ICT is based on market structure analysis, liquidity areas, trading volumes, and other variables to determine the best trade entries. The ultimate goal of ICT traders is to emulate the behaviour of institutional investors, also known as “smart money” players, in order to achieve consistent and profitable results.

Unlike other trading systems or software, ICT is not a one-size-fits-all approach. It is a collection of techniques, models and ideas that can be applied to different market situations and trading styles. Thus, it is a versatile strategy that can be adapted to a certain situation in the market.

The Techniques and Strategies Behind ICT Trading

Retail traders use ICT to look for imbalances in the market, investigate smart money’s trading behaviour patterns and profit from large price swings.

One key aspect of ICT is identifying institutional footprints within the markets, which involves closely monitoring the actions of big players, such as market makers and hedge fund firms.

Another important element is timing. ICT traders monitor the market sessions and look for specific times when trading volume is high enough to move prices quickly. This time is known as the “killzone,” and it’s where traders like to place their buy or sell orders.

Core ICT Concepts

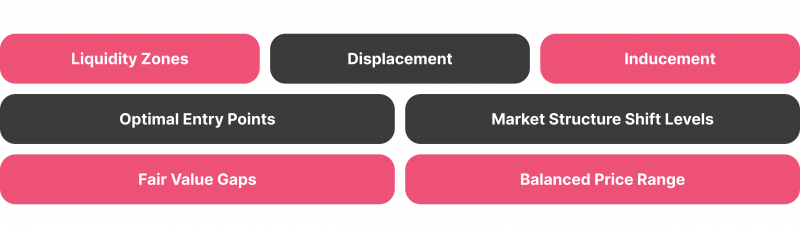

Several core concepts besides liquidity form the foundation of ICT trading strategy:

- Displacement: It refers to intense buying or selling pressure causing a price shift. This phenomenon can create a price gap and change in trend and is often seen following the breakthrough through a liquidity area.

- Inducement: It refers to the targeting of short-term highs or lows where liquidity lies, intending to take out stops and continue in the direction of the longer-term trend. It can be seen in chart patterns such as bull and bear flags.

- Optimal Trade Entry Points: These are the ideal points to enter a trade. Traders found them by using the Fibonacci retracement indicator. They typically lie between 61.8% and 78.6% levels.

- Market Structure Shift Level: This concept identifies key levels where previous trends reversed, signalling a potential shift in market direction. It is used as a reference point and can be seen when the price makes a lower low in an upward trend or vice versa.

- Fair Value Gaps: These are imbalances in the market that result in price gaps. ICT professionals keep an eye on these gaps as they can act as magnets to drive price changes.

- Balanced Price Range: This occurs when there is a sharp move up or down, which is then accompanied by a similarly dramatic movement in the opposite direction. It is characterised by a double Fair Value Gap and can signal a change in the market structure.