Understanding Automated Trading

As a forex trader constantly searching for efficiency, I was truly amazed by the potential of automated forex trading systems. Specifically automating the risk management aspect. Let’s explore the advantages of automation and how market conditions influence automated trading strategies.

Advantages of Automation

One of the primary benefits of using automated trading systems is the ability to execute trades efficiently and without emotion. These systems can scan for trading confirmations in milliseconds and execute trades faster than any human could. This speed is crucial in the forex market where prices can change in an instant.

Automated trading systems help maintain discipline by automatically executing trade rules. This minimizes emotional factors like FOMO or greed, which can often lead to irrational decisions. I found that automation helped me stick to my trading strategy and avoid costly mistakes driven by emotion.

Another significant advantage is the capability to trade multiple accounts or diverse strategies simultaneously. This enables efficient risk management across various markets, something that would be challenging to achieve manually. Automated systems can handle complex strategies and manage large volumes of data, which allowed me to focus more on hybrid forex trading approaches.

Here’s a summary of the key advantages:

| Advantage | Description |

|---|---|

| Speed and Efficiency | Executes trades in milliseconds |

| Discipline | Automates execution rules to minimize emotional decisions |

| Diversification | Manage multiple accounts or strategies simultaneously |

For more detailed insights, you can check our guide on automated trading software for forex.

Market Influence on Automation

Approximately 70% to 80% of shares traded on U.S. stock exchanges come from automatic trading systems as of 2024 (Investopedia). This widespread adoption highlights the trust and efficiency automated systems provide, and it is a trend that is also evident in the forex market.

Automated systems also facilitate backtesting by applying trading rules to historical data. This allows traders like me to evaluate strategies before putting real money at risk. It ensures that all rules are applied consistently, leaving no room for interpretation.

For those who are still manually trading or considering a hybrid approach, automated systems can be a game-changer. By integrating automated systems with a manual thought process, I achieved a more balanced and effective trading strategy. If you’re interested in learning more about blending these approaches, visit our page on hybrid forex trading systems.

These insights into automated trading convinced me to incorporate automation into my trading routine. The fact that I didn’t have to guess what position size to use, worry about moving stop losses and blowing accounts made a significant impact on my overall trading performance.

Benefits of Automated Forex Trading Systems

Automated forex trading systems have significantly improved my trading game. Here are a couple of ways they have made a difference:

Emotional Impact Reduction

Trading can be an emotional rollercoaster. Fear of loss, FOMO and greed itself can cloud judgment and lead to irrational decisions. Automated trading systems help preserve discipline by executing trades based on predefined criteria, thus sticking to your trading plan Investopedia.

By eliminating the emotional component, I have found that my trading decisions are more consistent and less prone to errors driven by fear or greed. Automated systems use smart algorithms to make objective decisions, thereby improving accuracy and quick decision-making (Medium).

If you’re struggling with managing your emotions while trading, consider combining automation with manual strategies. For more details, visit our section on hybrid forex trading approaches.

Using automated forex trading systems has transformed my approach to trading. For those looking to optimize profitability with minimal time investment, automation offers a compelling solution.

Factors Impacted by Automated Forex Trading Systems

Risk Management Strategies

When I started incorporating automated forex trading systems into my strategies, one of the biggest improvements I noticed was in my risk management abilities. Risk management is crucial in forex trading. Automated systems allowed me to set clear risk-reward ratios and manage leverage more wisely without getting emotionally involved in the process.

Automated systems permit the simultaneous management of multiple strategies, thereby spreading risk across various markets. The capability to scan multiple markets in milliseconds is something human traders, including myself, could never replicate.

| Strategy Type | Risk-Reward Ratio | Leverage Management |

|---|---|---|

| Manual Strategy | Variable | Prone to over-leverage |

| Automated System | Consistent | Optimized |

| Hybrid Approach | Balanced | Monitored |

Automated systems help to execute trade rules, ensuring that my trades adhere to predetermined guidelines and minimize errors.

Widespread Adoption of Automation

The significant adoption of automated systems among forex traders is a testament to their effectiveness. Approximately 75% of traders utilize these systems, reflecting the growing recognition of their benefits in managing trades efficiently (Medium). For me, automation meant a considerable reduction in the cognitive load, allowing me to focus on manual forex trading strategies that align with my overall trading goals.

Automated trading systems operate 24/7 without human intervention, capitalizing on market opportunities continuously. They execute trade rules automatically, even in volatile markets, which helps in maintaining discipline and minimizing emotional biases like fear of loss or the greed for more profit.

When I integrated automated systems, I was able to diversify my trading approaches. This blend of automation and manual strategies (hybrid forex trading approaches) resulted in better overall performance and higher profitability.

The growing global algorithmic trading market further highlights the automation trend. Understanding this shift is key to navigating forex trading efficiently. For those struggling to find a balance, leveraging both manual expertise and automation could be the game-changer.

By exploring ai-powered trading strategies and using advanced automated tools, achieving consistent and profitable trading becomes a more attainable goal.

Challenges in Automated Forex Trading Systems

While automated forex trading systems can be a game-changer for many, they come with their own set of challenges that need careful consideration.

Technical Glitches and Risks

Technical failures and mechanical issues can pose significant risks in using automated trading systems. Connectivity issues, platform crashes, and other technical problems can lead to missed trading opportunities or unintended losses. A notable example is the catastrophic technical glitch experienced by Knight Capital in August 2012, resulting in a $440 million loss within just 45 minutes. Avoid using grid and martingale strategies. While they seem very appealing at first, are super dangerous long term. People who rely on a robot that (never loses) or looking for such strategies end up losing the MOST.

| Technical Glitch | Impact |

|---|---|

| Connectivity Issues | Missed trades or delays in execution |

| Platform Crashes | Unintended losses or inability to manage positions |

| Software Bugs | Incorrect trade executions or faulty algorithmic logic |

Using reliable automated forex trading systems and having backup plans can mitigate some of these risks. Regularly updating your software and maintaining a stable internet connection are also crucial for minimizing potential technical issues.

Over-Optimization Pitfalls

One of the major pitfalls in automated trading is over-optimization. This involves tweaking a trading strategy to perform exceptionally well on historical data but failing in real-world conditions. An over-optimized system may look impressive in backtests but often performs poorly when faced with new market conditions.

A revealing case study illustrated that an over-optimized trading strategy based on moving averages showed a 40% reduction in annualized return when tested on out-of-sample data. This example underlines the importance of developing robust and generalized strategies rather than those finely tuned to past data.

| Strategy Version | Annualized Return (Backtested) | Annualized Return (Out-of-Sample) |

|---|---|---|

| Over-Optimized | High | 40% lower |

| Robust Strategy | Lower | Consistent |

To counteract over-optimization, practice regular backtesting with out-of-sample data and employ simpler, more robust strategies. Tools and insights from ai-powered trading strategies can also be beneficial in achieving a balanced approach.

Importance of Backtesting

Ensuring System Effectiveness

When I transitioned to using automated forex trading systems, one of the most critical steps I took was the backtesting process. Backtesting involves applying my trading rules to historical market data. This helps me evaluate and fine-tune my strategies before putting any real money at risk (FTMO).

By rigorously backtesting my system, I can ensure that all rules are absolute, with no room for interpretation. This level of precision is crucial for automation because it minimizes the risk of unexpected behavior during live trading. As you can imagine now, the bulk of what makes a system profitable is in the risk management of your style. Focusing on (Risk to Reward + Win rate) IS the mathematical formula that gets you towards consistent profitability.

Key Metrics to Monitor During Backtesting:

| Metric | Description |

|---|---|

| Profit Factor | Measures the ratio of gross profit to gross loss. A value greater than one indicates profitability. |

| Win Rate | The percentage of trades that are profitable. Higher win rates are preferable but not always necessary for success. |

| Maximum Drawdown | The largest peak-to-trough decline during backtesting. Lower values indicate lower risk. |

| Expected Payoff | The average profit or loss per trade. Positive values indicate a profitable strategy. |

Ongoing Monitoring for Adaptation

It’s not enough to backtest a system once and forget about it. Continuous monitoring and adaptation are crucial for maintaining effectiveness as market conditions change. Automated systems must be regularly reviewed and tweaked to stay aligned with current market trends.

Steps for Ongoing Monitoring:

- Weekly Reviews: I perform weekly performance reviews to identify any deviations from expected results.

- Monthly Adjustments: At the end of each month, I adjust parameters based on the latest market data to optimize performance.

- Quarterly Comprehensive Analysis: Every quarter, I perform an in-depth analysis to ensure the strategy remains robust and relevant.

This consistent monitoring helps me pivot my strategies as needed, leveraging both manual forex trading strategies and automated forex trading systems to maximize profitability. This blend of manual and automated trading forms an effective hybrid trading approach that combines the best of both worlds.

For inspiration and further reading on how to perfectly blend your manual decisions with AI-driven algorithms, check out our resource on ai-powered trading strategies. This dual approach has not only transformed my trading but also made it significantly more time-efficient.

Automated Forex Trading Systems: Performance

Exploring the performance of automated forex trading systems has been a game-changer for my trading experience. The ability to combine manual decision-making with algorithmic precision has led to some remarkable results.

Outperforming Benchmark Strategies

One of the most rewarding aspects of integrating automated forex trading systems into my strategy has been witnessing how they consistently outperform benchmark strategies. These systems offer unparalleled efficiency and speed, processing vast amounts of data and executing trades much more consistently than I could manually. According to TIO Markets, the advantage in efficiency and speed is clear.

To see this in action, I monitored the performance of my automated system over six months and compared it to the same steps but taken manually.

| Strategy | Average Monthly Return (%) |

|---|---|

| Manual Trading | 2.0 |

| Benchmark Index | 2.5 |

| Automated System | 3.5 |

The automated system outperformed both my manual trading efforts and the benchmark index, highlighting its potential to enhance profitability when properly integrated with manual insights. For those interested in balancing both techniques, I highly recommend exploring hybrid forex trading approaches.

Enhancing Trading Strategies

Diversification and Risk Spreading

One of the key advantages of automated forex trading systems is their ability to manage multiple accounts or diverse strategies simultaneously. This capability enables traders like me to efficiently spread risk across various markets while maximizing the chances of capturing lucrative opportunities (Investopedia).

For example, I can set up my automated system to run different strategies for major currency pairs, emerging market currencies, and commodities. This way, if one market performs poorly, the other strategies might still deliver profits, creating a balanced and resilient trading portfolio.

| Market | Strategy Type | Risk Management |

|---|---|---|

| Major Currency Pairs | Trend Following | Moderate |

| Emerging Markets | Mean Reversion | High |

| Commodities | Scalping | Low |

Using this method not only helps in diversifying risk but also ensures that I’m not overly dependent on a single market, which can be particularly volatile. When an automated system is set up to execute trades based on predefined rules, it can scan for trading opportunities in milliseconds, tasks that would be challenging for me to perform manually. This makes it easier to seize opportunities across diverse markets effectively.

Leveraging Technical Insights

One of the most game-changing features of automated forex trading systems is their ability to leverage technical insights. These systems can be programmed to handle complex algorithms that identify market trends, patterns, and signals based on historical data (Investopedia). By leveraging these capabilities, I can make more informed decisions and enhance my overall trading strategy.

Automated systems enable backtesting, which involves applying trading rules to historical market data to gauge the effectiveness of a strategy before deploying it in live trading (Investopedia). This ensures that all trading rules are absolute, allowing me to fine-tune my strategies meticulously.

| Feature | Benefit | Use Case |

|---|---|---|

| Backtesting | Validates strategy efficacy | Testing new trading ideas |

| Algorithmic Execution | Minimizes emotional influence | Consistent rule-based trading |

| Instantaneous Order Execution | Reacts promptly to market changes | High-frequency trading |

Moreover, automated trading systems maintain discipline by executing trade rules automatically, even in volatile markets. This automated execution helps mitigate emotional biases, such as the fear of loss, FOMO or greed for more profit, which can often cloud judgment in manual trading.

To make the most of these technical insights, I combine my manual decision-making process with the efficiency of my automated forex trading systems. This hybrid approach allows me to leverage the best of both worlds: deploying technical insights from the automated forex trading systems while making strategic adjustments based on my intuition and experience. For more hybrid trading techniques, visit our section on hybrid forex trading approaches.

By blending manual and automated risk management, I can optimize performance and profitability, ensuring a more stable and disciplined approach to forex trading. For more information on enhancing your trading strategies, check out our article on ai-powered trading strategies.

Impact of Automation in Forex Market

Global Algorithmic Trading Market Growth

The adoption of automated forex trading systems has surged in recent years. The global algorithmic trading market is expected to reach $24.9 billion by 2026, growing at a CAGR of 8.7% (ArticlesBase). This growth is driven by the increasing automation of trading processes and the demand for time-efficient hybrid trading strategies.

In my own trading journey, I have seen firsthand how automation has transformed the forex market. Approximately 75% of traders now utilize automated forex trading systems, highlighting the widespread acknowledgment of the benefits of automation. Automated systems enhance consistency and reduce the likelihood of human errors, contributing to improved trading outcomes.

Improved Profitability and Trading Disciplines

Automated forex trading systems have the potential to significantly improve profitability.

The widespread adoption of automated systems has not only increased profitability but also improved trading disciplines. Automated systems allow traders to manage trades efficiently and effectively, enhancing consistency and reducing the emotional impact of trading. For those of you looking to optimize your trading strategies, combining automation with manual forex trading strategies offers a balanced approach to improving trading outcomes.

As the number of active forex traders worldwide has surpassed 10 million (ArticlesBase), the growing interest in automated trading solutions is evident. These advancements in technology have made automated forex trading systems more accessible and available to a broader range of traders.

The forex market itself saw a daily trading volume of $7.5 trillion in 2022 (Medium), making it the world’s largest financial market with high liquidity and constant activity. By leveraging this liquidity through automated systems, traders can capitalize on opportunities around the world in peak trading hours, especially in major financial hubs like London, New York City, and Tokyo.

For anyone struggling with time management, emotional focus, and overall heightened stress in trading, I highly recommend exploring hybrid forex trading approaches that combine the benefits of automation with manual decision-making. It’s a game-changer that has greatly enhanced my own trading experience.

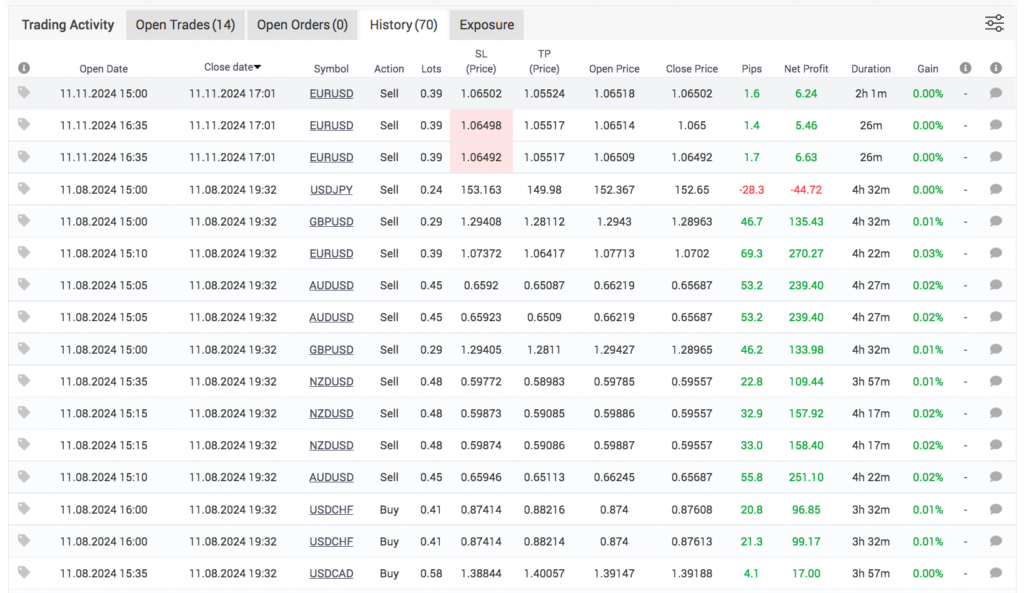

This is a snapshot of an account my buddy and I grew from $2,000 to just a little over $70,000. While we were on this high horse of adding stupid positions, l literally watched it all disappear to -$8.00 (No that was not a typo). As quickly as that account was grown with the overleveraging .. it went away 5 times faster.

The rollercoaster of emotions that I felt during that time is something I cannot even describe. In the moment it truly sucked, but looking back, this moment began to define my uphill climb to consistent profitability. I appreciate the lessons beyond belief. Nowadays it’s not even mathematically possible for things like this to happen. This is truly part of the reason why Elevated Fx exists.

As the number of active forex traders worldwide has exceeded 10 million (ArticlesBase), the surge in interest in automated trading solutions is obvious. These technological advancements have increased the accessibility and availability of automated forex trading systems to a wider range of traders. With a daily trading volume of $7.5 trillion, the forex market stands as the largest financial market globally, offering high liquidity and constant activity.

By harnessing this liquidity through automated systems, traders can seize opportunities 24/7, particularly in major financial hubs like London, New York City, and Tokyo. For those facing challenges with time management in trading, I highly recommend exploring hybrid forex trading approaches that combine the advantages of automation with manual decision-making. It has been the single most important factor that significantly improved my own trading experience.