The foreign exchange market, also known as forex, is a vast and highly liquid market where trillions of dollars are traded daily. With the potential for high returns, many traders are drawn to this market. However, achieving success in forex trading is not guaranteed and requires a solid strategy, discipline, and the ability to adapt to changing market conditions. This is where automated forex trading comes in, offering traders a powerful tool to enhance their trading results.

So What is Forex Automation Really?

Automated forex trading refers to the use of computer programs or algorithms to execute and/or manage trades based on pre-set rules and conditions. From simple scripts automating highs and lows of the month, to complex trading systems analyzing market data and executing trades automatically.

Forex automation can eliminate emotion and human error from the trading process. It allows for more precise execution of trades, helping traders stick to their trading plan, avoiding impulsive decisions, and enhanced profitability.

Benefits of Using Forex Automations

Eliminating Emotional Trading

One of the primary advantages of automation is its ability to eliminate emotional trading. Emotions often lead traders to make irrational and costly mistakes. By executing trades based on pre-determined rules and conditions, automation removes the emotional element from the trading process. Traders can avoid impulsive decisions driven by fear, greed, or other emotions, leading to more consistent and disciplined trading.

Minimizing Human Error

Even experienced traders can make errors, such as entering incorrect trade sizes or forgetting to set stop losses. Automation can help eliminate these types of mistakes by managing trades automatically based on pre-set rules. By reducing human error, traders can achieve more accurate and precise execution, leading to improved trading results.

Faster and Accurate Execution

In the fast-paced world of forex trading, speed and accuracy are crucial factors in determining profitability. Automation enables traders to execute trades faster and more accurately than manual trading. By removing the potential for human delays or errors, traders can take advantage of market opportunities as soon as they arise. This can be especially beneficial in volatile market conditions or when dealing with time-sensitive trading strategies.

Types of Forex Automation Systems

There are various types of automated forex trading systems available to traders, catering to different trading styles and strategies. Here are three popular types:

1. Expert Advisors (EAs)

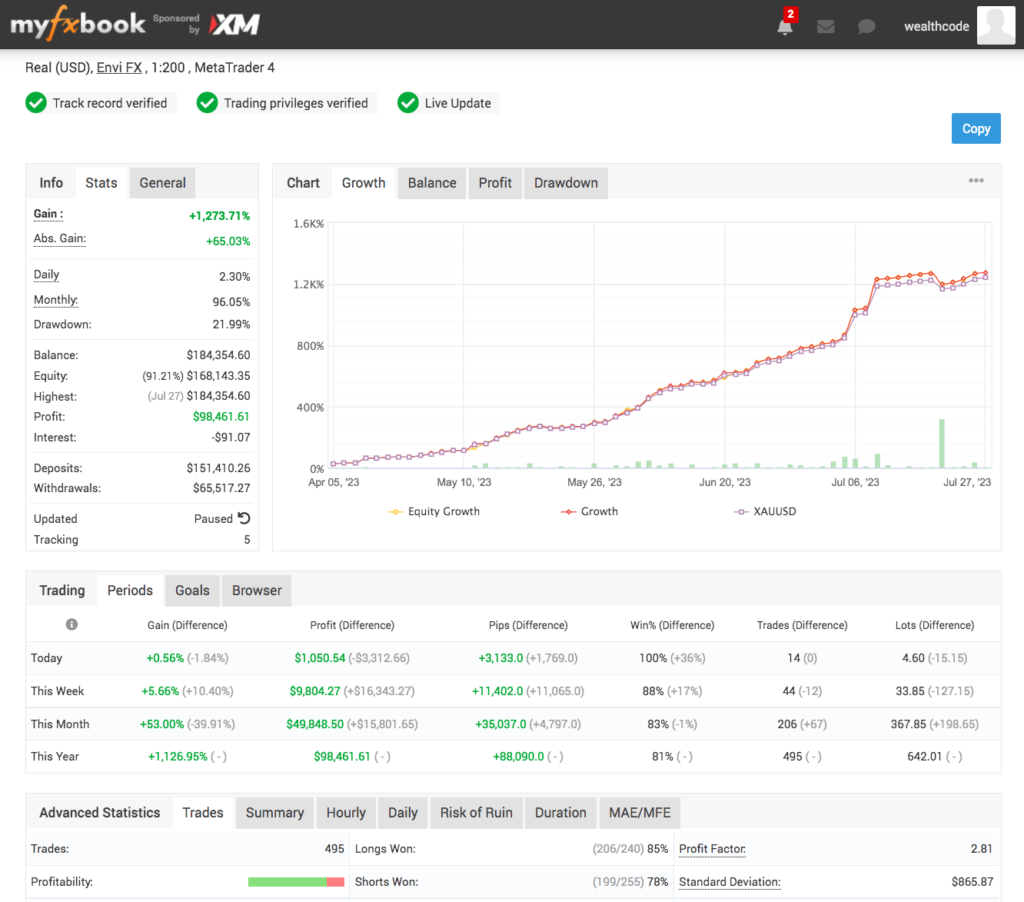

Expert Advisors (EAs) are computer programs designed to analyze market data and execute trades automatically based on pre-set rules and conditions. They are typically used within the MetaTrader 4 platform and can be purchased or programmed by the trader. EAs offer a high level of customization and flexibility, allowing traders to adapt their strategies to changing market conditions.

2. Forex Robots

Forex robots are automated trading systems that execute trades automatically based on pre-set rules and conditions. Marketed as “set and forget” systems, they require minimal input from the trader. Forex robots often incorporate advanced algorithms and strategies, aiming to provide consistent profitability. Traders can choose from a wide range of commercial forex robots or develop their own.

3. Copy Trading

Copy trading allows traders to automatically replicate the trades of other successful traders. This can be a valuable tool, particularly for beginner traders who are still learning the ropes. By following the trades of experienced traders, copy trading enables beginners to learn from their strategies and potentially achieve similar trading results. Platforms like eToro and ZuluTrade offer copy trading functionalities.

Factors to Consider When Using Forex Automation

While automation can be a powerful tool, it is essential to consider certain factors to maximize its effectiveness:

1. Testing and Optimization

Before deploying an automated forex trading system, it is crucial to thoroughly test and optimize it. Historical data can be used to simulate trades and evaluate the system’s performance under different market conditions. By identifying strengths and weaknesses, traders can make necessary adjustments to enhance the system’s profitability.

2. Monitoring and Adjustments

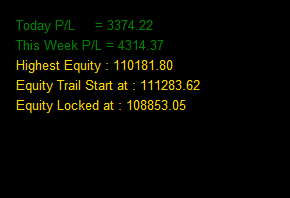

Forex Automation systems should be continuously monitored to ensure their effectiveness. Market conditions can change, requiring adjustments to the system’s rules and conditions. Traders should regularly review their automated systems, making necessary modifications to adapt to evolving market dynamics.

3. Risk Management

While forex automation can enhance trading results, it is vital to implement proper risk management techniques. Traders should define appropriate risk-reward ratios, set stop-loss and take-profit levels, and allocate capital wisely. By managing risk effectively, traders can protect their capital and achieve long-term profitability.

Conclusion

Automated forex trading can significantly boost the success of forex traders by eliminating emotional trading, minimizing human error, and enabling faster and more accurate trade execution. With various types of automated trading systems available, traders can choose the most suitable option for their trading style and goals.

However, it is important to remember that forex automation is not a guarantee of success. Traders must still develop a solid trading strategy, exercise discipline, and continuously monitor and adjust their automated systems to adapt to changing market conditions.

By utilizing forex automation wisely and incorporating effective risk management, you can potentially enhance your trading results and achieve greater profitability in the dynamic forex market. Use these tips to find the best forex software for consistent profits.