Introduction

Forex trading can be an incredibly lucrative journey, but it also comes with its fair share of risks. The key to success isn’t just about spotting opportunities; it’s about managing those risks effectively. Many traders enter the market with dreams of profits, but without proper risk management, those dreams can quickly turn into nightmares. This is where having a solid forex risk management strategy comes into play. In this comprehensive guide, we’ll cover the 8 most essential forex risk management strategies that every trader needs to know in order to maximize gains and protect their capital.

Whether you’re new to forex or a seasoned trader, these strategies will empower you to stay in the game longer and make better decisions. With ElevatedFX’s cutting-edge tools and expert guidance, you can harness these strategies to take control of your trading future.

Why Forex Risk Management Matters

Protecting Your Trading Capital

The primary goal of any trader should be to protect their trading capital. The forex market is highly volatile, and without the proper measures, a single mistake could lead to significant losses. Implementing effective risk management strategies is what separates successful traders from those who wash out after just a few losing trades. Protecting your capital ensures you have the resources needed to capitalize on profitable opportunities when they arise.

Maintaining Emotional Control

Trading can be highly emotional. When the market moves against you, it’s easy to get caught up in the heat of the moment, making irrational decisions that lead to even greater losses. Effective risk management strategies can help mitigate these emotional reactions by providing a set of rules to follow no matter what happens. ElevatedFX provides traders with tools such as iCue Manager to automate risk management and keep emotions out of the equation.

Achieving Consistent Profits

No strategy is perfect, and losses are inevitable in trading. However, the right risk management strategies can help you achieve consistency by ensuring that your profits outweigh your losses over the long term. Instead of focusing solely on getting the next big win, risk management encourages discipline, helping you stick to a consistent trading plan and achieve sustainable profits.

8 Forex Risk Management Strategies Every Trader Should Know

1. Risk-to-Reward Ratio

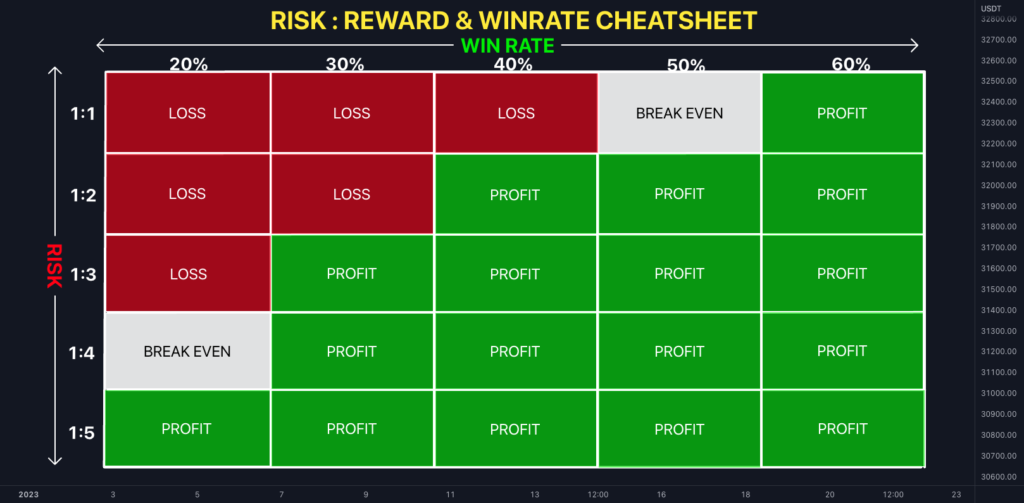

One of the foundational strategies in forex risk management is focusing on an appropriate risk-to-reward ratio. This ratio helps you determine how much potential reward you aim to achieve for the risk you’re taking. For example, a common risk-to-reward ratio is 1:3—meaning for every $1 of risk, you should target $3 in profit. Risk to reward alone will not get the job done, as that formula needs to match a high enough win rate to be profitable.

Why It Works

- Maximizes Profits: Ensures that you are getting more profit compared to what you risk on losing trades.

- Discourages Emotional Decisions: Having a predetermined risk-to-reward ratio allows you to make decisions based on logic rather than emotions.

Using ElevatedFX’s SmartBots, you can automate trades to adhere strictly to your risk-to-reward rules, keeping you disciplined.

2. Use Stop-Loss Orders

A stop-loss order is a preset order to close a trade when the market moves against you beyond a specific point. It’s a vital tool for limiting losses and preserving your trading capital.

Types of Stop-Loss Strategies

- Fixed Stop-Loss: Set at a certain distance from your entry point, often used for high volatility pairs.

- Trailing Stop-Loss: Adjusts dynamically to lock in profits as the market moves in your favor.

With tools like iCue Manager, traders at ElevatedFX can easily set up automatic stop-loss levels to manage risk on every trade.

3. Position Sizing

Position sizing involves determining how much capital you are going to put on each trade, ensuring you do not over-leverage and put your entire account at risk. The amount you choose to risk per trade should align with your overall trading strategy and risk tolerance.

Key Considerations for Position Sizing

- Percentage-Based Risk: Typically, traders risk between 1% and 2% of their account on a single trade.

- Volatility-Based Position Sizing: Adjusts position size based on market volatility, allowing you to take smaller positions in highly volatile conditions.

Using a Position Size Calculator, like those offered by ElevatedFX, can help you determine the optimal trade size based on your risk tolerance and the specific trade setup.

4. Avoid Overleveraging

Leverage can be a double-edged sword. While it can amplify your profits, it also increases your exposure to losses. Overleveraging is one of the most common reasons why traders blow their accounts.

How to Manage Leverage Wisely

- Use Low Leverage Ratios: Stick to conservative leverage ratios, such as 5:1 or lower, particularly when you’re starting out.

- Understand the Impact of Leverage: Ensure you understand how leverage works and its implications for both profit and loss.

ElevatedFX provides traders with comprehensive training to help them understand how to manage leverage effectively, preventing them from falling into the trap of overexposure.

5. Diversify Your Trades

Diversification is a strategy used to spread risk across different assets, reducing your overall exposure to any single market movement.

Ways to Diversify

- Currency Pairs: Trade a mix of currency pairs rather than putting all your capital into a single pair.

- Trading Strategies: Use different strategies for different market conditions (e.g., trend following, range trading).

Diversifying your trades allows you to lower the impact of unexpected market events, ultimately contributing to more consistent trading results.

6. Stick to a Trading Plan

A well-defined trading plan is crucial for profitable trading. It not only outlines your strategy and risk management approach but also keeps you focused on your goals and helps you avoid emotional trading.

What Should Be Included in Your Trading Plan?

- Risk Parameters: Maximum risk per trade, risk-to-reward ratios, etc.

- Trading Hours: When you will be trading, based on your availability and market conditions.

ElevatedFX offers tools that help traders create and stick to effective trading plans, ensuring that they follow a structured approach.

7. Use Hedging Techniques

Hedging is a strategy used to protect your existing positions from adverse market movements. In forex trading, hedging involves opening a new position in the opposite direction of an existing trade to minimize potential losses.

Common Hedging Methods

- Direct Hedging: Opening a position that directly offsets another position.

- Cross Currency Hedging: Using a correlated pair to offset the risk of a current trade.

Hedging can be an advanced strategy, but it’s a useful way to protect profits or mitigate losses during volatile market conditions.

8. Keep a Trading Journal

Keeping a detailed trading journal is an effective way to improve your risk management over time. A trading journal records the details of each trade, including the reasons for entering the trade, the outcomes, and what you learned.

Benefits of Keeping a Trading Journal

- Identify Weaknesses: Helps you identify recurring mistakes so you can correct them.

- Track Progress: Provides a record of your successes and setbacks, helping you gauge your improvement.

Using a tool like Tradezella, journaling is made simple and effective, allowing you to automate the tracking of your trades and gain deep insights into your performance.

Conclusion

Forex risk management is essential if you want to trade successfully in the long term. By incorporating these 8 forex risk management strategies into your trading routine, you’ll be better prepared to manage your risk, maintain discipline, and protect your capital. Remember, trading is not just about making money—it’s about keeping what you earn and building on it over time. ElevatedFX offers the tools and guidance you need to develop a solid, risk-focused trading plan that helps you reach your financial goals.

Ready to take your forex trading to the next level with a risk management plan that works? Download our Hybrid trading blueprint free to discover how to access industry-leading tools like iCue Manager, Ka$h Alerts, and other SmartBots designed to empower traders with disciplined, profitable trading strategies. Connect and take control of your trading journey!