So you want to know the key to consistent gains in forex trading?

Well, let me tell you about the phantom equity trail. This strategy can help you maximize your profits while minimizing your losses in the unpredictable world of forex trading.

By using a phantom equity trail, you can set a trailing stop that moves with the price of the currency pair, allowing you to lock in profits as the market moves in your favor. It’s like having a personal assistant constantly adjusting your stop-loss order to protect your gains. Sounds pretty amazing, right?

Well, in this article, we’ll dive deeper into how the phantom equity trail works and how you can implement it in your own trading strategy. So sit tight and get ready to learn how to make consistent gains in the forex market.

Want to learn more about the phantom equity trail and how it can revolutionize your forex trading? In this article, we’ll explain the concept in more detail and provide step-by-step instructions on how to set up and use a phantom equity trail in your own trading platform. Whether you’re a beginner or an experienced trader, this strategy can help you take your forex trading to the next level. So if you’re tired of inconsistent gains and want to increase your profitability in the forex market, keep reading.

The phantom equity trail might just be the game-changer you’ve been looking for. Stay tuned for more insights and tips on how to succeed in forex trading with this powerful strategy. Phantom Equity Trail is a powerful tool used in forex trading to manage risk and maximize profits. In this article, we will delve into the definition of Phantom Equity Trail, its importance in forex trading, the benefits it provides, how it works, factors to consider when using it, implementation strategies, common mistakes to avoid, examples of its application, a comparison with other stop loss strategies, and its impact on trading psychology.

By the end of this article, you will understand the significance of Phantom Equity Trail and how it can help you achieve consistent gains in forex trading.

What is Phantom Equity Trail?

Phantom Equity Trail refers to a technique used in forex trading to protect profits by trailing the stop loss behind price action. It is an alternative to traditional stop loss orders and allows traders to secure profits while still giving room for potential further gains. Unlike traditional stop loss orders that are fixed or based on a percentage of the entry price, the trailing stop moves dynamically with the market, adjusting itself based on predefined criteria.

Importance of Phantom Equity Trail in Forex Trading

Phantom Equity Trail plays a vital role in forex trading for several reasons. First and foremost, it helps minimize losses by protecting profits as the trade progresses. It ensures that even if the market reverses, the trader can exit the trade with a predetermined profit instead of experiencing a full loss.

Another crucial importance of Phantom Equity Trail is its ability to ensure consistent gains. By letting the profits run and capturing as much of the market movement as possible, traders can increase their overall profitability. It eliminates the need to try and time the exact top or bottom of a trade, allowing traders to capture substantial profits without the pressure of precision.

Furthermore, Phantom Equity Trail helps reduce emotional trading. Emotions often cloud judgment and lead to impulsive decisions. With the trailing stop method, traders can detach themselves from the trading process and let the market dictate when to exit the trade. This eliminates the influence of emotions such as greed or fear, resulting in more rational and informed trading decisions.

Lastly, Phantom Equity Trail has the potential to increase profit. By capturing as much market movement as possible, traders can ride profitable trends for an extended period. This prolongs the profit potential of a trade, allowing traders to capitalize on market momentum and maximize their returns.

Benefits of Using Phantom Equity Trail

Minimizing Losses

Phantom Equity Trail significantly reduces the risk of losses by locking in profits as the trade progresses. This allows traders to limit their downside and protect their initial investment.

Ensuring Consistent Gains

By trailing the stop loss behind price action, traders can ride profitable trends for an extended period, ensuring consistent gains in their trades.

Reducing Emotional Trading

Phantom Equity Trail eliminates the influence of emotions on trading decisions. Traders can detach themselves from the trading process and let the market dictate when to exit the trade, resulting in more rational decision-making.

Increasing Profit Potential

With Phantom Equity Trail, traders can capture as much market movement as possible, prolonging the profit potential of a trade and maximizing returns.

How Does Phantom Equity Trail Work?

The concept of Phantom Equity Trail involves setting an initial stop loss order and implementing a trailing stop to secure profits as the trade progresses. Here’s a breakdown of how it works:

Setting the Initial Stop Loss

To use Phantom Equity Trail, traders must first determine an appropriate initial stop loss level. This stop loss order is set based on technical analysis, support and resistance levels, or any other predefined criteria. It acts as a safety net, limiting potential losses if the trade moves against the trader.

Implementing the Trailing Stop

Once the trade starts moving in the trader’s favor, the trailing stop is implemented. The trailing stop is set at a specific distance or percentage away from the current market price. It moves dynamically with the market, always maintaining the predetermined distance.

Adjusting the Trailing Stop

As the trade progresses and the market price moves in the trader’s favor, the trailing stop is adjusted accordingly. The stop loss level follows the market price, always maintaining the pre-set distance or percentage. This allows traders to secure profits as the trade moves in their favor while still giving room for potential further gains.

Factors to Consider When Using Phantom Equity Trail

While Phantom Equity Trail can be a powerful tool, several factors must be considered when using it effectively:

Market Volatility

Highly volatile markets can result in rapid price movements, making it necessary to adjust the trailing stop more frequently. Traders must be aware of market conditions and adapt their trailing stop strategy accordingly.

Timeframe of Trading

The timeframe in which a trader operates can have an impact on the effectiveness of Phantom Equity Trail. Different timeframes may require different trailing stop distances or percentages to accommodate varying levels of market volatility and price fluctuations.

Trade Entry and Exit Points

Determining optimal trade entry and exit points is important when using Phantom Equity Trail. Traders must rely on technical analysis, market indicators, and their trading strategy to identify favorable entry and exit points that maximize profit potential.

Risk Appetite

Each trader has a unique risk appetite that must be taken into consideration when using Phantom Equity Trail. Traders must assess their risk tolerance and set the trailing stop distance or percentage accordingly. Aggressive traders may set a tighter trailing stop, while conservative traders may opt for a wider trailing stop distance.

Strategies for Implementing Phantom Equity Trail

There are several strategies for implementing Phantom Equity Trail, depending on the trader’s preferred trading style and objectives. Here are three common strategies:

Trend Following Strategy

Traders using a trend-following strategy can implement Phantom Equity Trail to ride profitable trends. The trailing stop is adjusted as the market moves in the direction of the trend, allowing traders to capture gains while remaining in the trade for as long as the trend is intact.

Breakout Strategy

When implementing a breakout strategy, traders can use Phantom Equity Trail to secure profits once the market breaks out of a defined range or pattern. The trailing stop is adjusted as the breakout occurs, allowing traders to capture potential momentum and maximize profit potential.

Support and Resistance Strategy

Traders utilizing a support and resistance strategy can apply Phantom Equity Trail to protect profits when the market reaches key support or resistance levels. The trailing stop is adjusted accordingly, ensuring that profits are secured while still allowing room for potential market breakthroughs.

Common Mistakes to Avoid When Using Phantom Equity Trail

While Phantom Equity Trail can enhance trading performance, certain mistakes should be avoided to ensure its effectiveness:

Setting the Stop Loss Too Close

Setting the initial stop loss order too close to the entry price can result in premature exits and missed profit opportunities. It is essential to give the trade enough room to breathe and allow for minor market fluctuations.

Moving the Trailing Stop Too Early

Moving the trailing stop too early may hinder profit potential. It is crucial to let the market dictate the movement of the trailing stop and avoid premature adjustments that may limit gains.

Ignoring Market Conditions

Failure to consider market conditions, such as high volatility or low liquidity, can lead to ineffective use of Phantom Equity Trail. Traders must adapt their trailing stop strategy accordingly to align with prevailing market conditions.

Not Adjusting the Trailing Stop

Failing to adjust the trailing stop as the trade progresses can result in missed profit opportunities. Traders must actively manage their trades and regularly update the trailing stop to secure profits and maximize returns.

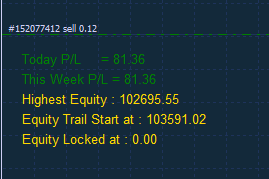

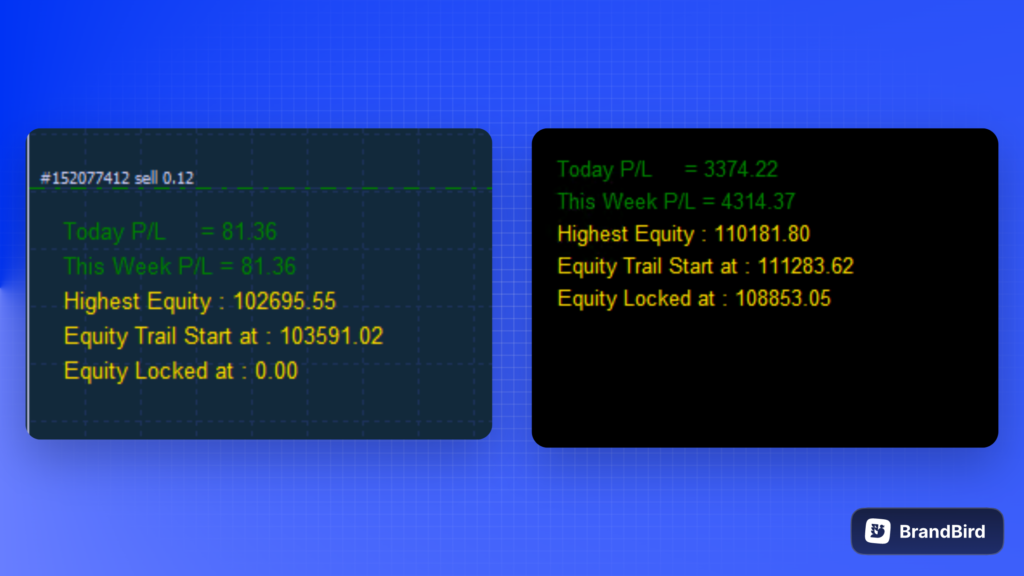

Examples of Phantom Equity Trail in Forex Trading

To illustrate the application of Phantom Equity Trail in forex trading, here are two examples:

EUR/USD Trade Example

Suppose a trader enters a long position on EUR/USD at 1.2000 with an initial stop loss set at 1.1950. As the trade progresses and the market price moves in the trader’s favor, the trailing stop is implemented 50 pips away from the current market price. If the market price reaches 1.2050, the trailing stop is adjusted to 1.2000. This process continues as long as the trade remains profitable, allowing the trader to capture gains while still giving room for potential further gains.

GBP/JPY Trade Example

Consider a trader entering a short position on GBP/JPY at 150.00 with an initial stop loss set at 150.50. As the trade progresses and the market price moves in the trader’s favor, the trailing stop is implemented 50 pips away from the current market price. If the market price drops to 149.50, the trailing stop is adjusted to 149.00. This adjustment is made continuously as long as the trade remains profitable, protecting profits while still allowing for potential further gains.

Comparing Phantom Equity Trail to Other Stop Loss Strategies

Phantom Equity Trail offers unique advantages compared to other stop loss strategies commonly used in forex trading. Here’s a comparison with three popular stop loss strategies:

Fixed Stop Loss

Unlike a fixed stop loss, which remains at a predetermined level throughout the trade, Phantom Equity Trail adjusts the stop loss dynamically with the market, allowing traders to secure profits and minimize losses as the trade progresses.

Percentage-based Stop Loss

While a percentage-based stop loss orders that the stop loss percentage remains constant throughout the trade, Phantom Equity Trail allows traders to capture more profits by trailing the stop loss behind price action. It takes into account market movements and adjusts the stop loss accordingly.

Volatility-based Stop Loss

A volatility-based stop loss sets the stop loss level based on market volatility. While this approach considers market volatility, it does not provide the flexibility and adaptability offered by Phantom Equity Trail. The trailing stop in Phantom Equity Trail moves dynamically with the market, ensuring optimal profit potential and risk management.

Impact of Phantom Equity Trail on Trading Psychology

Phantom Equity Trail has a significant impact on trading psychology, helping traders achieve emotional balance and make better trading decisions. Here are some ways it can affect traders’ mindset:

Building Confidence

Successful implementation of Phantom Equity Trail in profitable trades reinforces a trader’s confidence in their strategy and decision-making abilities. The ability to secure profits and maximize gains contributes to psychological well-being, leading to increased confidence in future trades.

Managing Greed and Fear

Phantom Equity Trail eliminates the need to time the exact top or bottom of a trade, reducing the pressure associated with precision trading. This helps traders manage feelings of greed and fear, as they can let the market dictate when to exit the trade, rather than making impulsive decisions based on emotions.

Improving Discipline

Implementing Phantom Equity Trail requires discipline and adherence to pre-set rules. Traders must have the discipline to regularly adjust the trailing stop and secure profits as the trade progresses. This promotes discipline in following the trading plan and eliminates emotional decision-making.

Conclusion

Phantom Equity Trail is a powerful technique that can greatly enhance a trader’s performance in forex trading. By minimizing losses, ensuring consistent gains, reducing emotional trading, and increasing profit potential, Phantom Equity Trail provides traders with a competitive edge in the forex market. When correctly implemented and adapted to market conditions, Phantom Equity Trail can be a game-changer in achieving consistent gains and maximizing profitability. Incorporate this technique into your trading strategy and unlock its full potential for success.